Those items for shipment to countries outside of the U.S. may be subject to taxes, customs duties and fees levied by the destination country ("Import Fees"). The recipient of the shipment is the importer of record in the destination country and is responsible for all Import Fees.

To Avoid The Brokage Fees ( Import Fees ) Follow These Step

Keep in mind that these steps may vary for different countries

Step 1: Don't Pay The Courier Custom Fee or Accept Delivery

For most people that don't know how, you'll feel like you won't have a choice but to pay. However, in order for self-clearing to work, you can't pay the charges and you also can't accept delivery.

The thing is, once you've paid, you've contractually accepted the courier's customs fees and there's no way to reverse it.

Step 2: Wait Until The Package Has Landed in Canada

Follow your tracking and wait for the item to arrive in Canada

You'll feel like you want to jump the gun immediately after receiving your tracking number but you can't do anything unless your package has physically landed in Canada and started the clearance process.

Contact number for UPS is ( 1-800-742-5877 )

When you call, let them know you'll like to self-clear your package. Make sure you have your tracking number. They'll ask for your e-mail address and they'll be able to generate the documents you'll need.

What CBSA is looking for in the document is the text “released under the LVS courier program”.

Where some frustration comes into play is that companies like UPS will pretend to not know what you're talking about when you ask about self-clearing. If that happens to you, make sure you continue to pester them and keep calling back.

Step 5: Visit CBSA to Pay Tax and Duties

Before you head out, make sure you print the documents you received in Step 3. You will also need a piece of ID. Your driver's license will be sufficient.

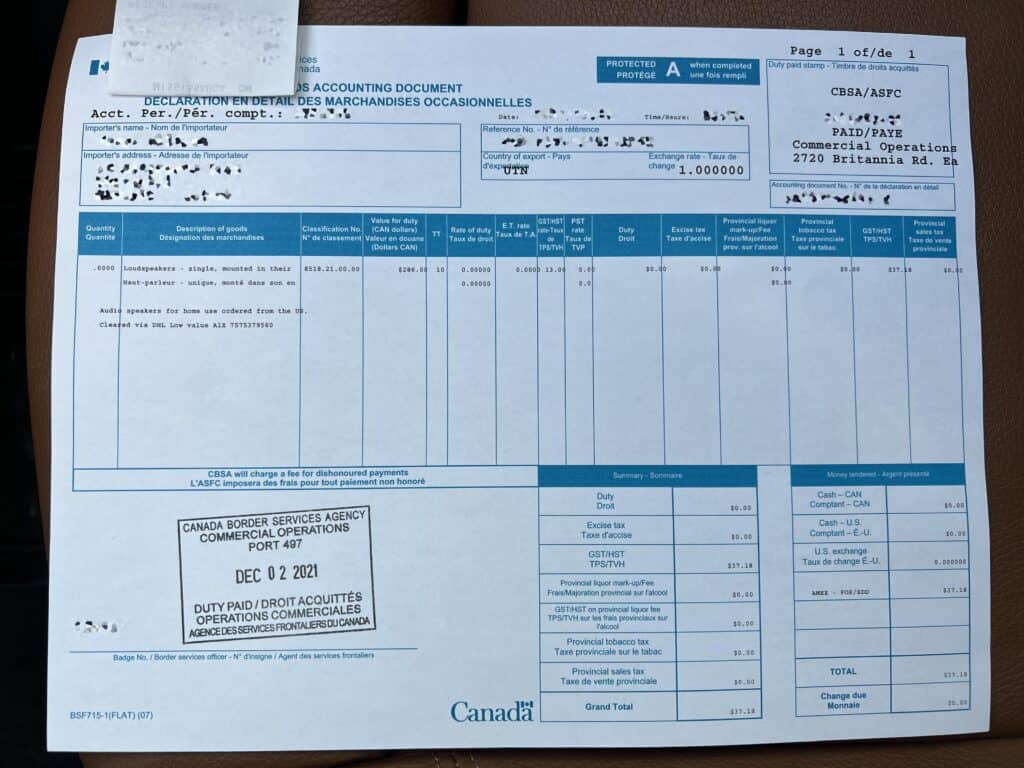

The cashier is at a separate booth which is practically next to the officers. Here, you'll pay the taxes (and duties if owed) and they'll print out a “Casual Good Accounting Document with a stamp that says “Duty Paid”.

This a “stamped manifest”.

TIP: Yes, they take credit card and American Express is accepted.

Exception: If your package is being held for further inspection, you will need to go to warehouse where it's being held. This is a rare case but could happen if your items have a high risk of being questioned or they are extremely large and expensive shipments.

Step 6: Email Photo of Receipt and Send to Courier

In Step 3, The delivery courier will provide instructions for what to do once the duty/taxes have been paid, including an e-mail address to send this to.

HOW QUICKLY DO YOU NEED TO SELF-CLEAR?

It's worth highlighting how quickly you need to do this self-clearing process. Do you need to do it immediately or do you have some time to work with?

Yes, you probably want to do this as soon as you can because couriers will not hold your package indefinitely. For customs brokerage specifically, there is a hidden fee called “warehouse storage”. This is applied when packages remain in the warehouse for longer than 2 days.

For UPS, this cost is $20 + $0.04 per lb per day according to their rate guide. For FedEx, this is outlined by their ancillary clearance services which is $0.25 per lb per day. Lastly, DHL provides 3 calendar days before they charge $7.50 + $0.20 per kg per day.

Note that this policy is different from their standard customer vacation hold that companies offer because customs clearance is involved.